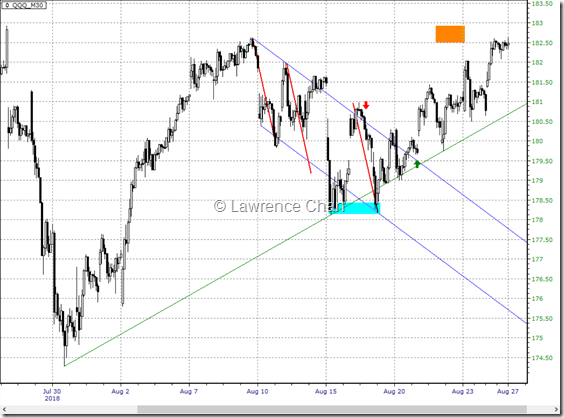

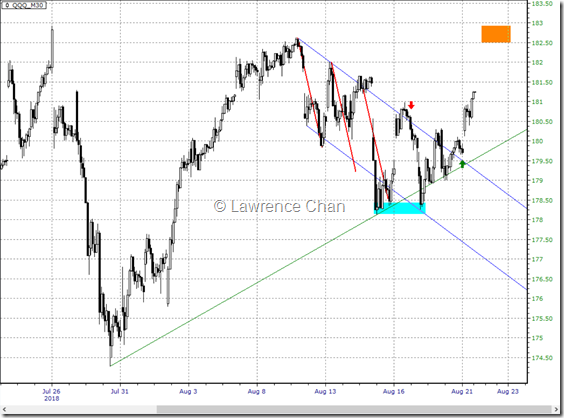

This is a follow-up on my post back on the 21st. This is the same 30-minute chart as of today.

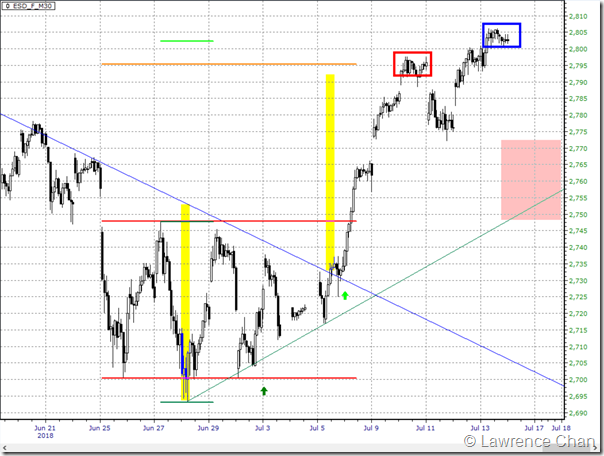

Notice how QQQ (and Emini NQ too) holding up at the up trendline (green line) as support even though there was an external sell shock forced the price to move lower.

And now we have tagged the target (orange zone).

This example is a classic case that you hear all these bearish opinions publicized by the media, yet the markets are doing what they are supposed to do. Then the media (and TV personalities) blame the market for moving higher. Instead of telling the truth that they do not know what they are talking about, they make up more excuses to confuse the public.

Don’t let them.

You do not need fancy technical indicators or complicated analysis to trade profitably.

Learn to read price charts correctly today!