Many readers are asking for short term analysis on Bitcoin.

Here is the continuous Bitcoin future daily chart.

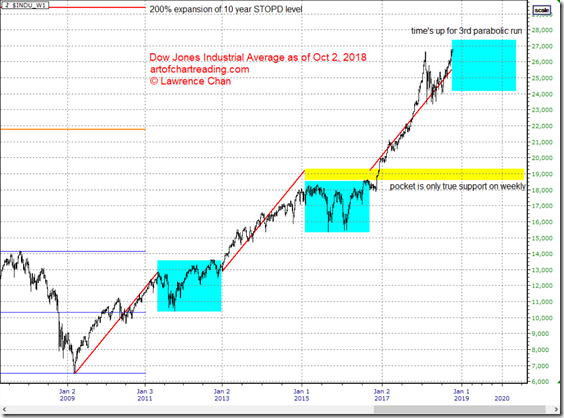

Context

1. Bitcoin experienced the classic 75% crash from its all time high near 20,000.

2. Since the spike low back in February it has tried hard to settle down but just like any other market, post crash price actions are usually more bearish.

3. The down channel (blue parallel lines) like price action was terminated with channel mid reversal (blue arrow) and false breakout against first quarter low.

4. Breakout of the channel was meant with a strong selloff back down to retest the channel top and the first quarter low (green arrow).

Short Term Outlook

a. A clean breakout above the resistance trend line (green line) will likely give a run to target around 10,000.

b. IF, BTC manages to stay above 2nd quarter high after #a happened, it will in turn create the potential of what is often called Adam and Eve bottom. Whether the pattern will work out is too early to even think about it since the breakout part has not even happened.

It is not that difficult to read a chart properly. Understanding how to engage the market correctly will keep your trading risk under control while the profits will take care of themselves as always. Get my book and learn my system of chart reading.