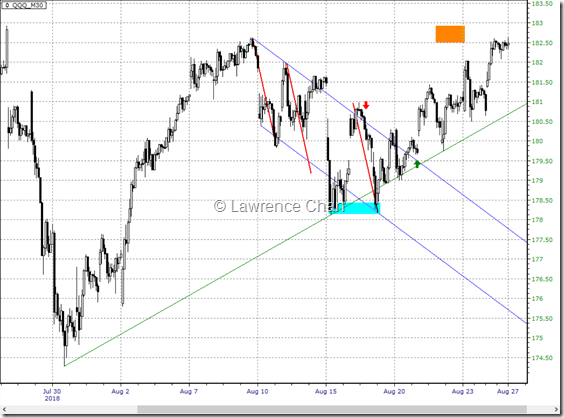

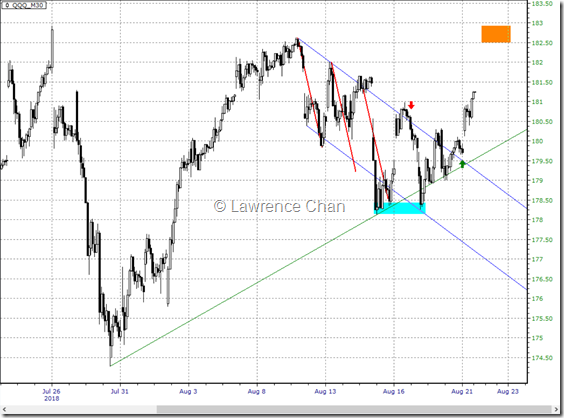

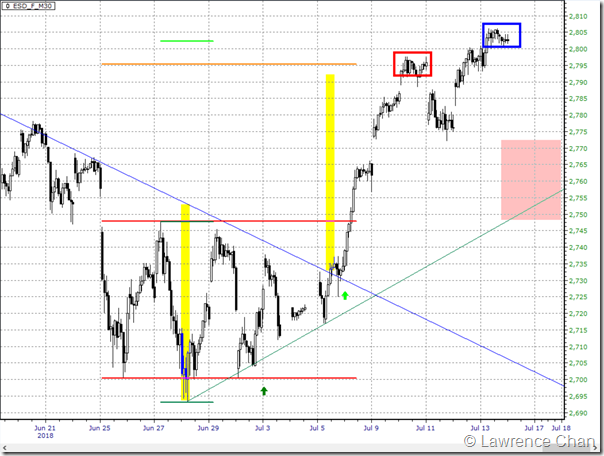

I was talking about Nasdaq 100 (QQQ and NQ) is ready for gap and go to much higher price level in my real-time commentary.

Here are some of the reasons directly from the chart.

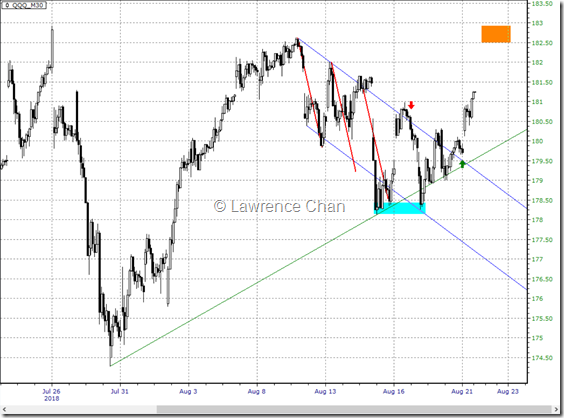

On 30-min QQQ chart:

1. Down channel established as of Aug 13th (blue lines)

2. Intention to produce 3 pushes down (red lines)

3. Bounce from 3rd push materialized but blocked from going higher by the gap and forced to go lower when price re-entered the channel (red down arrow)

4. Up trendline established as of Aug 15th

5. Retest of swing low from Aug 15th also aligned with test of down channel.

6. On Aug 20th closed above channel, as long as price stays above the channel, or a bull flag on higher timeframe, will give us the last swing high (orange zone)

Many people assumed they know how to read a chart properly. Instead of accepting their ignorance, they choose to believe they already know everything in my book, The Art of Chart Reading.

Maybe, they have a collection of ideas how to read a chart. But that is not how it works. Chart reading has to be done systematically so that you can arrive at the proper conclusion with no bias from your personal opinions. And what I offer in the book is the framework to achieve exactly that.